How much can I borrow? Understand the mortgage calculation to find your borrowing capacity

The first step of buying real estate often involves finding out how much you can borrow. This helps you to target your search and discover your buying potential. The latter depends on several factors. Firstly, the funds that you wish to use for the project. Then, your borrowing capacity, which depends on your income, profile, and the particularities of your project. We explain the factors that come into play in this complex calculation.

Do you want to discover your buying capacity straight away? e-Potek provides Switzerland’s most accurate mortgage calculator! Simulate your purchase in a few clicks.

Your personal contribution – own funds

As a matter of prudence, lenders require that you cover a share of the total cost of the purchase. Most of the time, you must cover at least 20% of the property’s purchase price. Excluding exceptions (contact us to find out more), at least 10% of the purchase price must come from your liquid assets: savings, third pillar, life insurance, gifts, securities, etc. The remaining balance may come either from your liquid assets or your second pillar (also called LPP) when you purchase a primary residence.

You must also cover transaction fees that come to 3-5% of the property’s value. They depend on the purchase price, the mortgage loan, and how the real estate will be used. They are calculated according to the canton, which establishes its own rules. These fees include transfer tax, land registry registration, and notary fees. They also include fees related to the bank guarantee that you must provide to the lender.

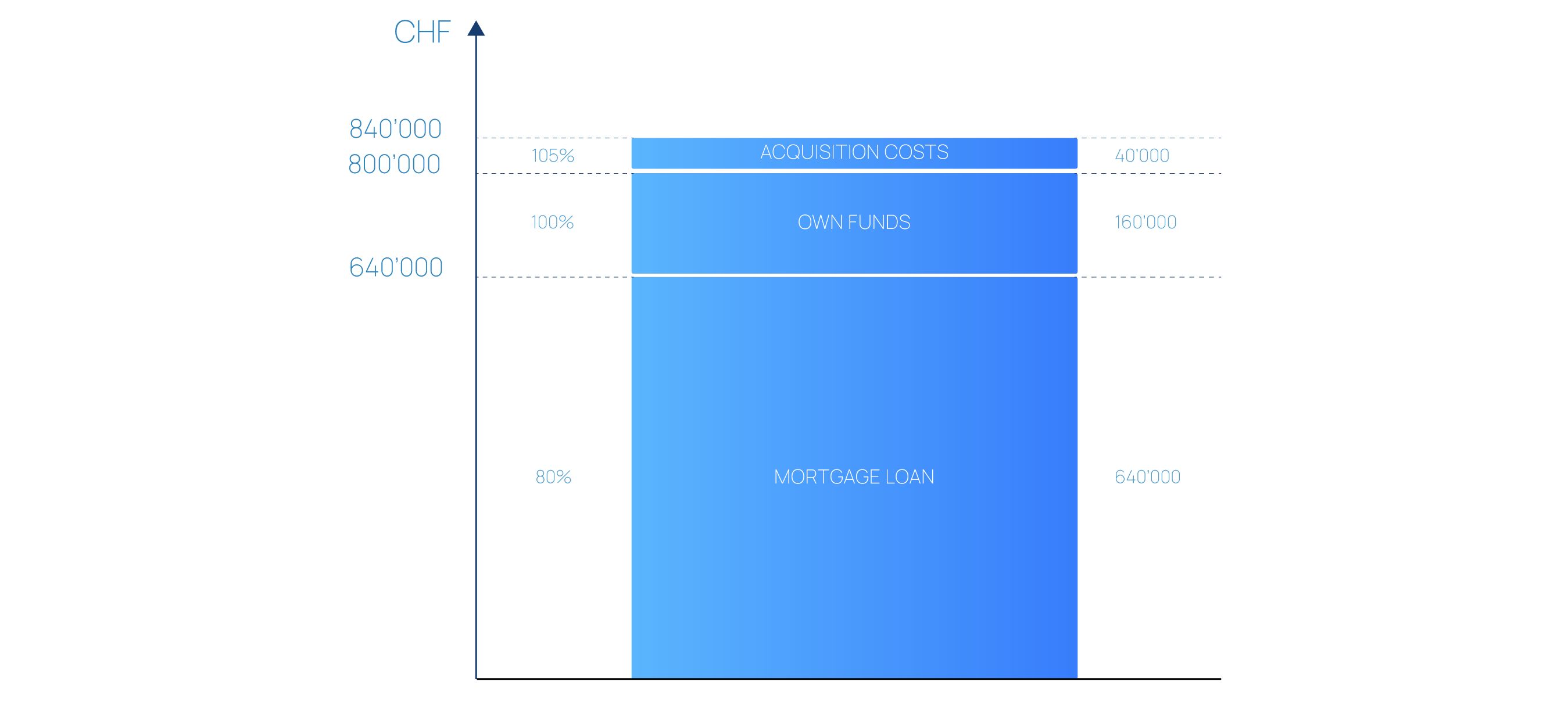

To demonstrate this, to purchase real estate for 800,000 CHF, a purchaser must have the following own funds to ensure funding:

- 20% of the purchase price: 160,000 CHF of which at least half must come from liquid assets

- 5% of the purchase price (purchase fees): 40,000 CHF in liquid assets

For a total of 200,000 CHF of own funds of which at least 120,000 CHF must come from the borrower’s liquid assets.

Own funds required to purchase a property that costs CHF 800'000 (estimates)

If you wish to deduct a purchase price from your available own funds, we can perform the calculation the other way around. Take the example of a buyer who has 75,000 CHF of liquid assets and 50,000 CHF on their second pillar that they wish to use for their purchase. Considering only the own funds and supposing that they have sufficient income, they can acquire real estate up to a value of 500,000 CHF. In this case:

- 20% of the purchase price: 100,000 CHF will be covered by own funds, including 10% in liquid assets

- 5% of the purchase price (purchase fees): 25,000 will be covered by liquid assets.

These calculations are, of course, not sufficient as borrowing capacity, which depends on income, must also be taken into consideration. However, they do make us aware that the personal contribution required is significant and can quickly become a limiting factor.

How do I calculate my borrowing capacity?

To complete the sum required to purchase property, usually 80% of the purchase price, the future owner can take out a mortgage loan. The amount of this loan will depend on their borrowing capacity.

The latter is calculated according to your financial revenue, existing charges (leasing, consumer loans, pension) and future charges related to your purchase. These correspond to what you will pay for your loan and the maintenance of your home. We call them installments and they are paid every month. They include interest, loan amortization, and maintenance fees.

Mortgage interest corresponds to the cost of your financing. It represents the value of your mortgage loan annually multiplied by the fixed interest rate. For mortgage calculations, lenders use a theoretical interest rate, usually set at 5%. This value, much higher than current rates, helps ensure that your financing will remain bearable in the long term whatever happens to market rates.

This security margin was implemented following the economic crisis of the 1990s when rates soared to over 7%. Many owners were unable to cover their financial charges. They found themselves needing to sell their home at a time when prices had dropped substantially.

Amortization corresponds to the repayment of a part of your loan. Usually until the remaining amount is at 65% of the value of the property (find out more about the composition of a loan). For the estimation of your borrowing capacity, it is spread, theoretically, over 15 years. This period is often increased by that which separates the oldest borrowers from retirement age. This depends on the rules applied by each lender.

Maintenance fees correspond to all the expenses required to maintain your property in good condition. They represent less than 1% of the value of the property annually. For the calculation, they are theoretically estimated at 1%. For information, not all lenders take them into account in the calculation.

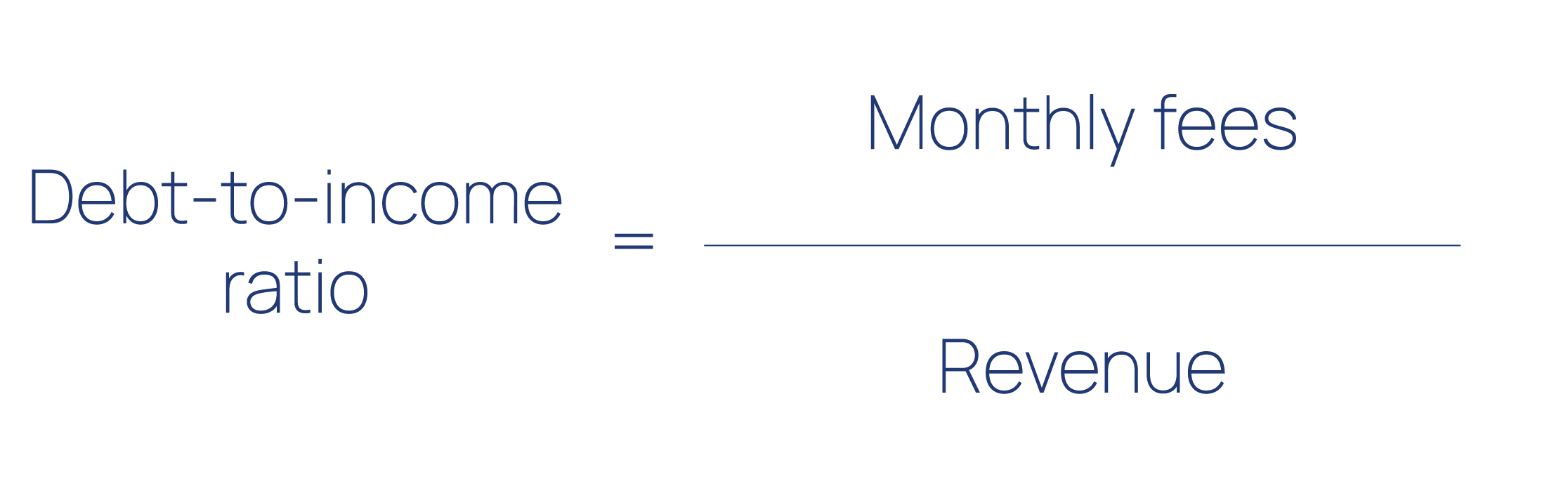

Most lenders in Switzerland limit the amount that can be borrowed so that the ratio between your revenue and the monthly payments, the debt-to-income ratio, does not exceed a certain limit, usually 33%. The consideration of existing charges depends on the lender.

However, there are exceptions for which it is possible for monthly payments to exceed a third of household income. For example, depending on the age or profession of the borrowers, remaining disposable income, or the loan amount. Contact us to find out more

Let’s go back to the example of the property worth 800,000 CHF that we used in the previous paragraph. If the buyer contributes 20%, they will need a loan of 640,000 CHF (80% of the value of the property). Here are the details of the calculation for the income required to support the mortgage loan:

- Theoretical interest represents annually 640,000 CHF x 5% or 32,000 CHF (~2,700 CHF per month)

- Theoretical amortization will represent annually (640,000 CHF - 800,000 CHF x 65%)/15 or 8,000 CHF (~667 CHF per month)

- Maintenance fees will come to 800,000 CHF x 1% or 8,000 CHF annually (~667 CHF per month)

This comes to a total of 48,000 CHF per year; the combined revenue of the borrowers must, therefore, be at least 144,000 CHF.

Looking at it the other way round, taking income as a starting point, is a little more complex. Fortunately, the e-Potek calculator gives you a result in just a few clicks.

Assess your buying capacity in just a few clicks

For free, no engagement required

Other factors that affect your buying capacity

The rules used by financial institutions to award mortgage loans will be different according to certain criteria. For example, if you borrow alone or with a partner, depending on your age, or your professional or family situation. Your income and charges will not be considered in the same way. Similarly, you must contribute more or less own funds.

The use that you intend for the property you wish to purchase also affects your buying power. For example, when buying a second home, lenders require more own funds.

Acquisition fees, including notary fees, vary significantly from one canton to another. The location of the property you are looking for or want to buy will also have an impact.

For example, for a property valued at 1,000,000 CHF, notary fees represent around 32,700 CHF in the canton of Geneva compared to 45,500 CHF in the canton of Vaud.

Finally, rules and criteria for granting real estate credit vary from one lender to another. For example, they do not consider your bonus in the same way or your net profit if you work for your own business. Interest rates and theoretical amortization may also differ.

The choice of financial institution, therefore, is very important beyond the rates on offer as this can have significant implications for your buying capacity. It can be advantageous to use a finance broker who will do the comparison work for you.

To easily find your way on the real estate market and get the best loan, e-Potek advisors support you and find the most appropriate financial solution for your needs and requirements.

Simulate your project online or contact our teams to move forward.