Mortgages in Switzerland – explanations

Getting a mortgage loan is a key step in the process of buying real estate. Several factors must be considered when you take out a mortgage in Switzerland. You must assess which type of mortgage is best suited to your needs and take its amortization into account in your budget. We present a round-up of all you need to know before getting started.

What is a mortgage?

From a legal standpoint, a mortgage is an encumbrance on real estate, in other words, a right that gives its beneficiary (the borrower) the possibility of selling the real estate to be reimbursed.

Unless an individual can finance their project in full using their own funds, a mortgage is agreed every time a property (an apartment or house) is purchased, a buy-to-let investment is made, work begins, or a construction project is launched.

The prospective owner pledges the property they are buying and, in exchange, they receive a loan from a mortgage provider that they use together with their own funds to complete the transaction. For the owner, the loan involves costs that are set out in a contract: monthly payments, which include, amongst other things, interest linked to the mortgage rate and the amortization of the loan. The encumbrance on real estate is used as security for the bank if the owner is unable to pay these costs. If that happens, the bank is allowed to sell the property to cover its costs.

The various rules in place concerning the income and own funds required by borrowers to be awarded a mortgage loan exist precisely to avoid this type of situation occurring.

A mortgage does not, therefore, refer directly to the loan itself but rather to the encumbrance on the real estate. The term mortgage is often misused to refer to the credit allocated by the lender. To be more accurate, we should use the term mortgage loan.

How can I get a mortgage loan?

To obtain a mortgage loan from a bank or insurance company, the prospective owner must fulfil two main criteria, the loan-to-value ratio and the debt-to-income ratio, for which the lender agrees to grant a loan.

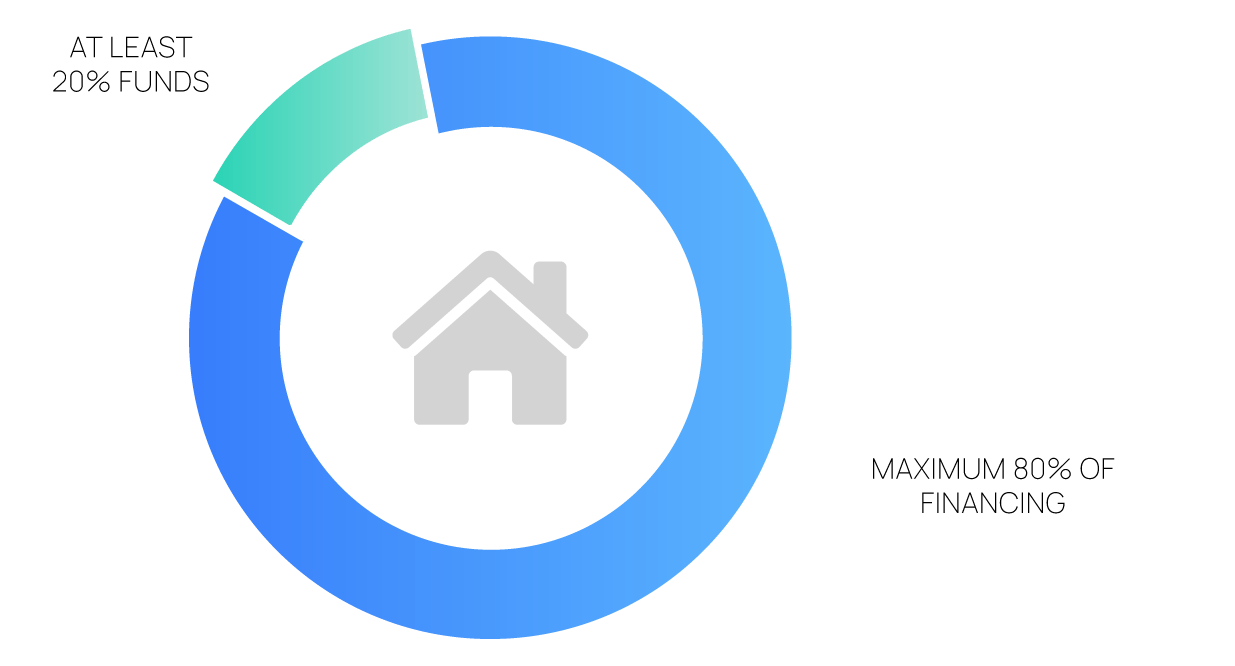

What is the loan-to-value ratio?

The loan-to-value ratio indicates the relationship between the capital borrowed and the value of the real estate. It usually goes up to a maximum of 80%. This means that the mortgage loan represents, at most, 80% of the object’s value – the remaining 20% must come from the borrower’s own funds. Our advisors can, however, negotiate with lenders to obtain a loan-to-value ratio of 90% or even 100% if the conditions allow it.

Repartition between your own funds and your mortgage loan

And the debt-to-income ratio?

The debt-to-income ratio (DTI) indicates the relationship between the costs associated with the real estate (mortgage interest, amortization, and maintenance fees) and the borrower’s income. In general, it should not exceed 33% and the calculation takes any existing costs (e.g. leases or other loans) into account.

There are, however, exceptions in which certain lenders accept a slightly higher ratio (up to 40%) depending on, for example, the age or status of the borrowers, their combined income, subsistence allowances, or the amount of the loan.

Each lender applies its own subtleties in determining these two rates and setting their maximum value (the maximum loan-to-value ratio is often higher for a primary residence than for a secondary residence, for example). They may also apply other criteria to decide whether or not they can grant a loan and for how much (nationality or age of the borrowers, location of the real estate, etc.)

It is quite complicated to obtain a complete list of these criteria, which makes precise calculation difficult.

If you would like to discover your buying capacity with all the financial institutions on the market, the Resolve calculator considers all the intricacies of loan award criteria to give you the most accurate results in just a few clicks.

Assess your buying capacity in just a few clicks

Where should I go for a mortgage?

In Switzerland, a mortgage loan can be agreed by a bank, an insurance company, or a pension fund. Banks remain the main financing choice for private clients but insurers have a significant presence and often have better rates to offer.

The range of institutions that can accompany you with your project presents a good opportunity because it allows you to play the competition to get the best conditions. However, it is not always easy to find your way through the multitude of offers available. This is why the advice of a broker may be necessary for your project.

What are the main types of mortgage?

In Switzerland, three main types of mortgage can contribute to financing real estate: a fixed rate mortgage, a variable rate mortgage, and the SARON mortgage (formerly LIBOR).

1. Fixed rate mortgage

For a fixed rate mortgage, the borrower and the financial institution agree on the amount of credit and the interest rate is fixed for the duration of the contract, usually between 1 and 15 years. For certain products, terms of more than 20 years are also possible. With Resolve, fixed rates for up to 25 years are feasible, sometimes even without repayment penalties. Once the contract has been signed, the fluctuations in market rates have no more impact. This model has, therefore, been particularly appreciated in recent years as the rates are relatively low.

2. Variable rate mortgage

In this case, the interest rate changes according to market fluctuations. No contract term is set. The variable mortgage is, therefore, extremely flexible; it can be terminated without incurring penalties within a relatively short term of three or six months. The disadvantages of this model are the higher risk, much greater than for other models, and the lack of transparency as lenders can change their rates without justification.

3. SARON mortgage

For a SARON (formerly LIBOR) mortgage, the interest rate is determined according to an interest rate that is usually calculated for one, two, three, six, or twelve months. SARON mortgages are agreed in the same way as fixed rate mortgages but for a set period, often between two and six years. Contrary to fixed rate mortgages, they have a variable interest rate. This rate, however, does not follow the SARON on a day-to-day basis; it is set at regular intervals agreed by the client and the lender (for example, every three or six months).

Deciding which type of mortgage loan to take out is not easy as it depends on two key factors, changes to interest rates and the risk profile of borrowers. Each option has its advantages and disadvantages and it is only a thorough analysis of the project and borrower profile that can be useful in making a decision. Once again, specific advice and consideration of all the solutions on the market can help you make the best choice.

What does a mortgage cost?

Anyone who agrees a mortgage owes money to the bank. As well as paying interest on the mortgage and maintenance costs, the owner must also pay the amortization of their mortgage.

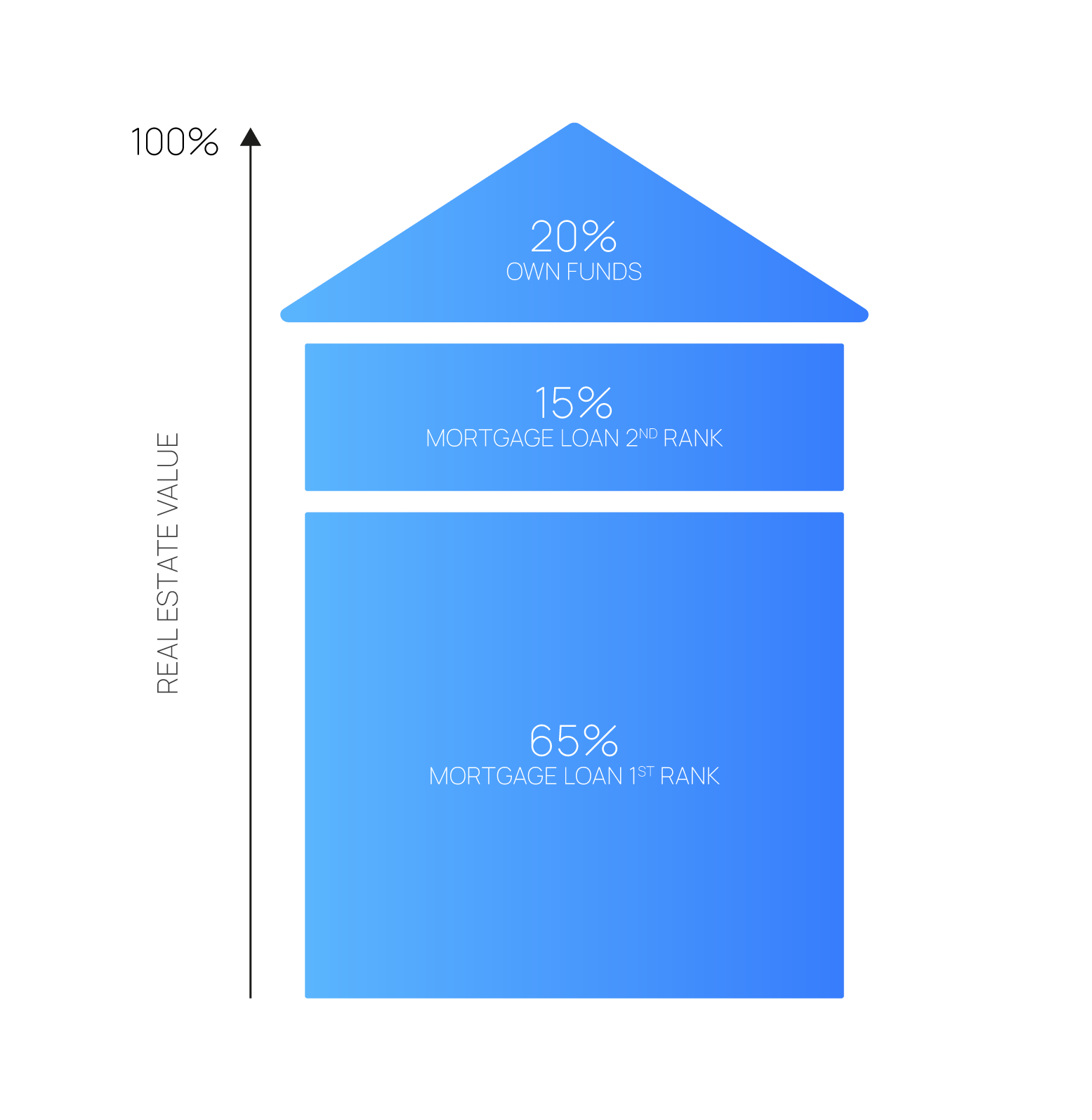

For information, a mortgage loan is usually divided into two parts: the first part (0-65% of the market value of the property) and the second part (between 65% and the rest of the credit, usually 80%). Contrary to the practice in France, where borrowers must repay the whole of their loan, in Switzerland, only the second part must be amortized. This part must usually be repaid within 15 years and before the borrower retires (for the oldest if there are two borrowers).

Structure of a mortgage loan

Amortization may be direct or indirect; the main difference between these two systems lies in what happens to the debt.

In the case of direct amortization, the borrower makes regular payments to the lender’s account. The amount of the loan is reduced every year as is the associated interest. However, as a result, the associated tax deductions will also decrease and the amount of income tax owed will increase.

Learn more about amortization strategies

Finding the best financing can be complicated and time-consuming as it requires knowledge of mortgage financing and being aware that each institution grants credit according to its own rules. To easily find your way on the real estate market and get the best loan, Resolve advisors support you and find the most appropriate financial solution for your needs and requirements.