What is a mortgage certificate ?

When a buyer takes out a mortgage, the financial institution lends a sum of money that may not be repaid. The mortgage certificate ties the loan to a piece of real estate that becomes the collateral.

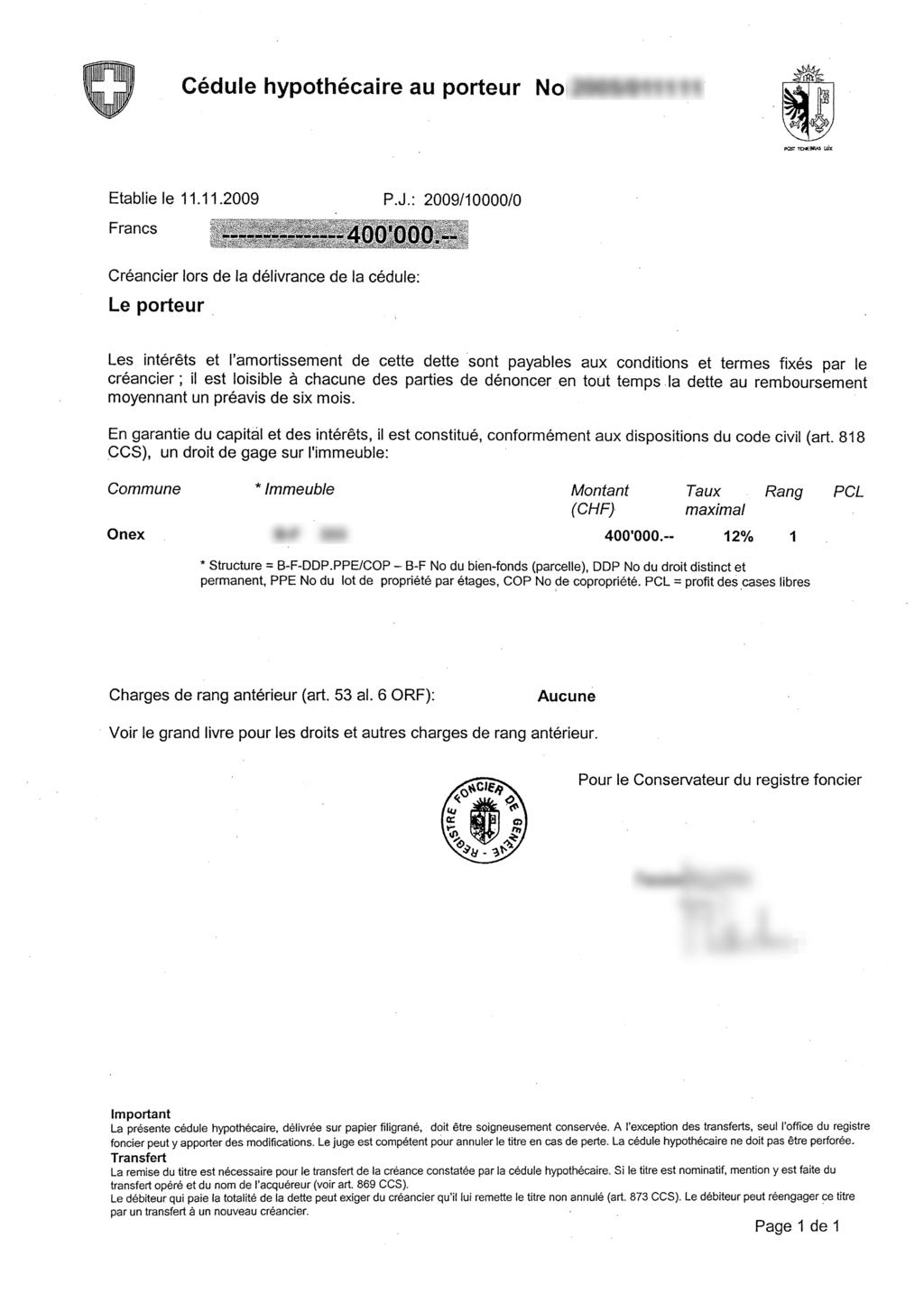

A mortgage certificate, it is a paper of value established by a notary which indicates :

- the amount that the creditor can claim from the debtor in case of default

- the real estate that provides the guarantee

- the maximum interest that could be due

Thus, if the debtor (the buyer) does not pay the interest or the loan, the creditor (the financial institution) has a right of lien on the real estate and can initiate a procedure so that the debt collection office organizes an auction to recover its debt, before any other creditor.

Example of a mortgage certificate (source: Wikipédia).

What does a mortgage certificate look like?

Traditionally issued in paper form and physically kept by the financial institution, the mortgage certificate has existed since 2012 in virtual form, called a register certificate, in certain cantons. The virtual version is nominative, meaning that the holder of the certificate is listed in a registry, while the paper version can be a so-called "bearer".

How much does a mortgage certificate cost?

The establishment of a mortgage certificate varies greatly from one canton to another. In Geneva, for example, it costs about 2% of the amount of the mortgage. This cost includes stamp duties, land registry fees, notary fees and VAT. In Zurich, the cost is 0.25%.

Can a mortgage certificate be modified?

When selling a property, the owner can resell or transfer the mortgage certificate to the buyer free of charge. The custom differs from canton to canton. In the canton of Vaud, for example, it is generally transferred free of charge, whereas in Geneva it is often sold for 1% instead of the usual 2%.

If you buy another property in the same canton, it is possible to keep the same mortgage certificate and transfer it to the new property and have it adjusted according to the amount of the new loan. However, since the certificates are specific to each canton, it is not possible to keep the same certificate for a purchase in another canton.

It is also possible to modify a mortgage certificate if the mortgage debt increases, for example to carry out renovations.

In case of a change of credit institution at the time of a rate renewal, the mortgage certificate will be transferred to the new institution.

Unlike in other countries, the mortgage guarantee (the certificate) does not expire, even if the mortgage is repaid in full. It is possible to have it cancelled or reduced at the Land Registry, but since it can be reused for a new acquisition or for work, it is wiser to keep it, so as not to have to pay a new one. In any case, even if over time the guarantee shows a higher amount than the mortgage loan, the financial institution will not be able to claim more than what is due.

Why does the mortgage schedule show such a high rate?

Mortgage certificates include a maximum interest rate, usually set at 12%. This is a standard requested by lending institutions and notaries automatically propose it, but this does not mean that the lending institution could claim a 12% interest rate.

The notaries automatically enter the maximum rate so that the buyer does not have to pay additional fees in case of future changes. This does not allow creditors to claim anything that is not stipulated in the loan contract.

In fact, in the event of a forced sale, the lender must present the loan contract attached to the mortgage certificate and can only claim the contractual conditions. The mortgage certificate only allows the lender to start the forced sale procedure with the debt collection office.

Currently, mortgage interest rates are around 1% and there is little chance that they will increase disproportionately, even though during the real estate crisis of the 90's we saw rates explode up to 9% or 12%. See the rate trends

It happens that some buyers borrow money from private individuals and not from banks or insurance companies. For example, when they do not have enough equity, when they are no longer loan-worthy in the eyes of lending institutions or when they encounter problems that do not allow them to obtain a standard mortgage loan. In such a scenario, it is possible to see loans ranging from 5% to 12% per year. The maximum defined by law is 17%... beyond that the loan is no longer legal. If a buyer were to borrow from a third party at 13%, but the certificate stipulates a maximum rate of 12%, the lender wishing to claim interest (in the event of the borrower's default) would only be able to do so at 12%.