Protection in the event of death or disability

By subscribing to a third pillar with an insurance company, you benefit from protection against various risks. The 3a pension plan combines a guaranteed retirement capital with coverage tailored to your needs for the risks of disability and death.

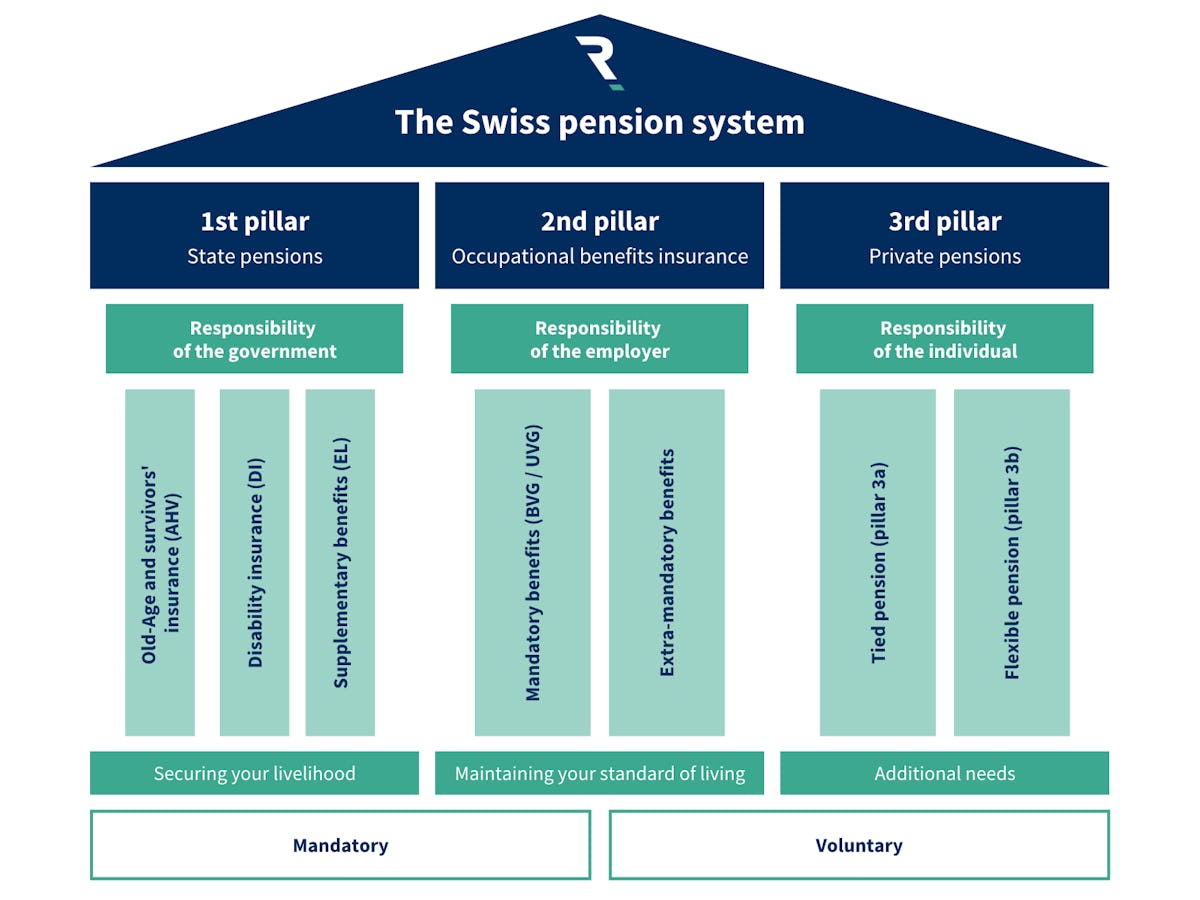

In the event of an accident or illness that partially or fully prevents you from working, two options are available to you depending on your degree of disability: either you receive a pension for a specified period, or you benefit from the waiver of premium payments. This latter option guarantees maximum security, as in the event of loss of income, the insurance covers the premium payments until you are able to return to work or until the contract ends, without affecting your savings. With a third pillar, you also benefit from life insurance, ensuring the financial protection of your loved ones. The third pillar is therefore an ideal solution for saving while planning for your retirement. However, it is important to distinguish between tied pension plans (pillar 3a) and flexible pension plans (pillar 3b), which offer distinct advantages in terms of taxation, choice of beneficiaries, savings amounts, and withdrawal flexibility. Therefore, it is essential to choose the most suitable solution to avoid any unpleasant surprises.

Do you have any questions or would you like non-binding pension advice? Resolve's advisors will explain it all to you in detail.