The financing certificate: the document you need for a successful purchase offer

Are you planning to buy a property in Switzerland? A financing certificate will confirm your solvency and specifically enables you to reassure sellers and real estate brokers. It's an undeniable asset if you want your loan application to get ahead of the rest!

If you're looking for a property then you know better than anyone that the competition is fierce! It is therefore important to make sure your loan application stays on top of the pile so that it gets priority. As such, it is vital for you to prove how reliable your finances are, so you can reassure your contacts. That's where this valuable door-opening document comes in.

Get a financing certificate online

What is a financing certificate?

As its name suggests, this document is designed to certify that you are fully solvent and that you are capable of funding a given property.

This means you have:

- sufficient equity to cover the necessary contribution and acquisition costs

- income enabling you to pay the mortgage you are likely to need.

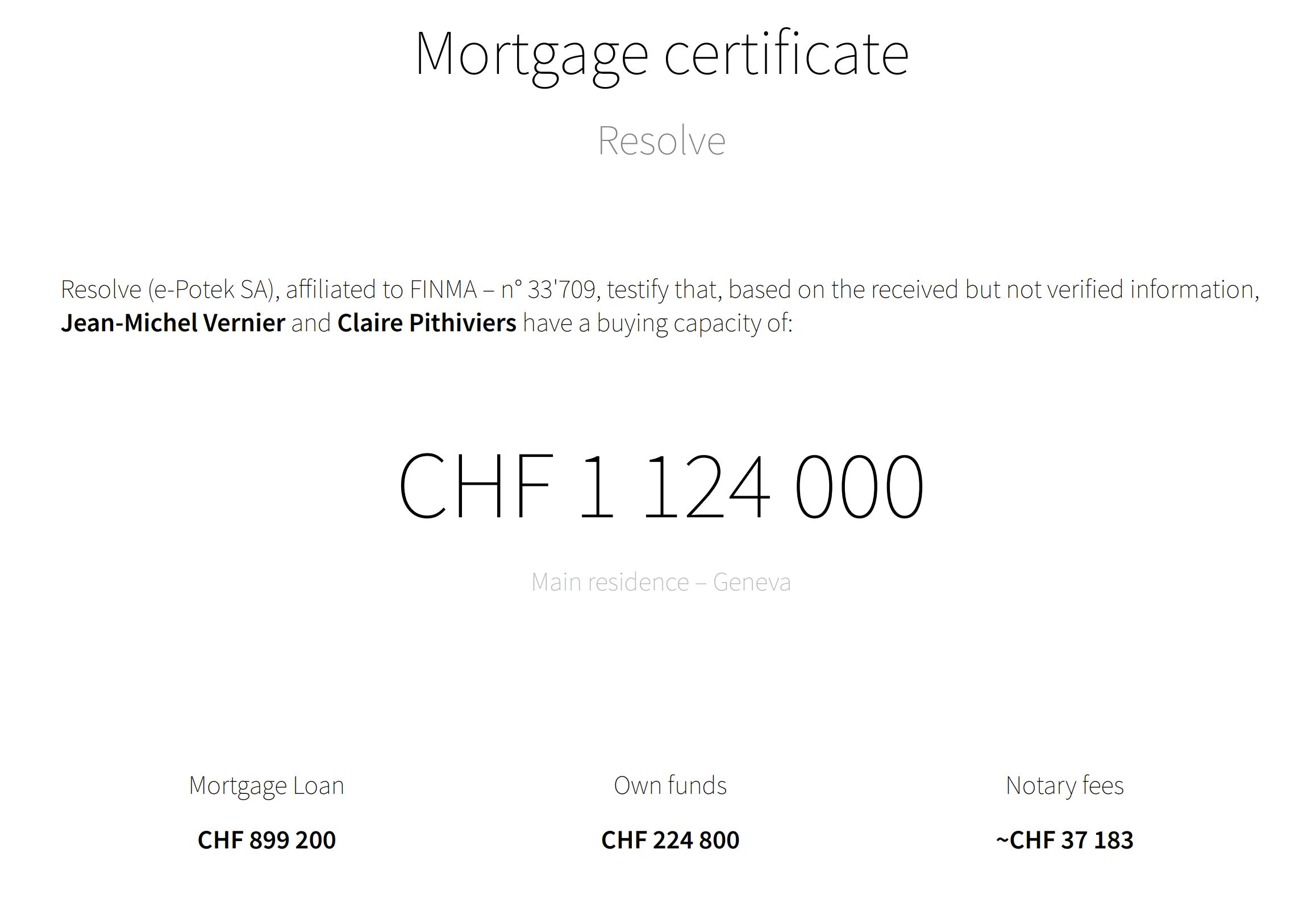

A financing certificate can be attached to a specific property, in which case it certifies that you can acquire it at the price indicated. It doesn't have to be related to any specific project, and can simply indicate your maximum financial capacity. In all cases, it usually attests to the following financial details:

- The maximum fundable amount OR the price of the property

- The amount of equity that you can contribute and which will be used as a contribution

- The amount of acquisition costs you will need to cover

- The mortgage amount you can commit to paying.

This document is not mandatory, and it does not really have any legal value, nevertheless it can be a real asset if you want your file to stand out from the crowd.

Trust between the seller, the real estate broker and yourself is essential for your purchase to succeed. A financing certificate makes your profile more credible and reassures those you have to deal with. If the seller receives an offer without proof of solvency, they must wait to find out if the potential buyer will actually be able to obtain a loan, and they may end up wasting time if the transaction falls through. By proving you are capable of funding your purchase, the seller and their broker know they won't be running this risk.

You could, to the same end, decide to send them all your financial data, but given its confidential nature and complexity, having a simple and well-formatted document is preferable for everyone.

Last but not least, if you are upstream of your purchase project, and you're still looking, a financing certificate means you can progress in confidence.

How do I get a financing certificate?

You can ask your banker, or a financing broker like e-Potek for this valuable document. In any case, it will be non-binding, and there is no legal obligation to follow everything that is written on there (for example, you can revise the equity/mortgage loan distribution later).

The calculations of your financial capacity strongly depend on your financial partner. Therefore, it is often better to go through a broker for your financing certificate, since this will then be based on the most advantageous lender for you.

It is also very important to inquire about how much time it will take to issue this document. You may need it sooner than expected! At e-Potek we have two types of attestations that deal with any eventuality.

An agreement in principle

Our mortgage calculator enables you to generate a financing certificate online. This is based solely on the information you provide. These details are not checked by anybody, so the certificate will only be “in principle”. It also has a note on it stating "on the basis of the unverified information provided".

Our algorithm enables your profile to get through the granting criteria of all lenders. The results about your financing capacity are therefore very accurate and that is why we think it helps to already provide an initial document.

Of course, it is less legitimate than a definitive financing certificate, but it means you can already demonstrate you are taking steps to prove your solvency. And the majority of our real estate broker partners do actually take it into consideration.

Get a certificate with no commitments

A definitive certificate

Our advisors can quickly issue you a definitive certificate. To do so, they will need to see documents from you about:

- Your income

- Your bank assets

- Your capital

- Your real estate assets

- Any other document validating your financial data

- All documents relating to your existing loans

This will enable them to validate all your information and certify your financeability with the help of our mortgage simulator.

All they need to produce this valuable document is just a brief analysis of your file. It is best to make an appointment with your advisor to speed up the process. And also to have all your documents ready.

Obviously, the e-Potek financing certificate in no way commits you to finalising your mortgage loan with us.

When should I ask for a financing certificate?

Even though it is not mandatory, we recommend that you have your financing certificate ready with you when you go to look at property. You can adjust it to a given price (the price of the property in question, for example), or you can certify your maximum financing capacity, but this could compromise your bargaining power.

The latest time for producing it is during your purchase offer, when you should attach it to give your application more weight. However, we strongly recommend that you compile your financing file upstream so you can work out your financial capacity, thus enabling you to move forward quickly once you have identified a property. In 85% of cases, planning ahead enables you to position yourself ahead of other interested parties.

In any case, this is something we advise you to look into as soon as possible; it is a free process with no obligations attached and means you can be sure of yourself as well as making any potential offers credible. So you have nothing to lose!

Last but not least, if your finances change, don't forget to have this document updated to avoid unpleasant surprises.

Our advisors are at your disposal if you want to find out more. Make an appointment for free.