e-Potek is now Resolve: why we changed our name

Four years after our creation, we've decided to change to a new name that reflects our ambitions.

We've been supporting our clients and partners with real estate projects from the start, making it quicker and easier to get a mortgage, with a more transparent process. Thanks to our online platform and specialist expertise, we can identify the best solutions on the market.

Our approach has rapidly earned its stripes. The business has carved out a market niche and people have been starting to recognize the e-Potek name. But we think we could do more.

Why this name change?

There are three main reasons why e-Potek is now Resolve:

💡 We offer comprehensive support: the best mortgage is about more than the best rate

Our clients aren't just looking for a mortgage: they want to carry out a real estate project (often the project of a lifetime). So, we can't limit ourselves to just finding the top mortgage rates. We support clients through every stage of their projects, taking into account everything affected by the decision to buy or refinance a property, including risk management and taxation. Rather than focusing exclusively on the present, we consider all timeframes to help our clients purchasing real estate optimize what tax they pay over the long term and safeguard their futures.

While we've always offered this comprehensive bespoke support, the name e-Potek didn't convey it well enough or reflect the extent of our services.

🕵🏼 We support different groups: private clients, real estate professionals and Premium clients

We support private clients as well as real estate professionals. We don't compete with the latter: we collaborate and offer tailored solutions to facilitate their work, securing transactions, speeding up processes and providing transparency at every stage. The same applies to developers, who we support with financing their projects and facilitating the sales process.

We also have a Premium department offering bespoke support to high-net-worth clients who often have unusual requirements. Our wide-ranging services cover personal property acquisitions (main and second homes, yachts, jets and works of art) and real estate investments (developments and property portfolios).

While we've always supported these different types of clients, the e-Potek name could suggest we only work with private individuals. We want real estate professionals and Premium clients to know we have solutions tailored to their individual needs.

🇨🇭 We operate nationally and are opening new branches across Switzerland

We have offices in various areas of French- and German-speaking Switzerland and plan to open more branches in future. It's important for us to be able to meet the growing demand from certain regions.

The e-Potek name posed some linguistic challenges. Resolve flows better and can be understood in all languages.

Therefore, our new name is more holistic and suited to what we are and what we will become. It solves our different issues and represents us better.

What is our approach?

While buying an apartment or a house is a wonderful undertaking, many people find it a complicated operation that involves a lot of questions. The significant financial investment, long and complex process, financial jargon and multiple elements to manage simultaneously (borrowing, insurance, taxation, etc.) can be extremely stressful for future buyers. We're here to help clients resolve everything and answer their questions so they are free to make the best decisions about all aspects of financing...with peace of mind!

Our advice allows people to look at financing from a new perspective. They stop seeing a mortgage as a necessary evil and instead consider it a financial opportunity and security for the future.

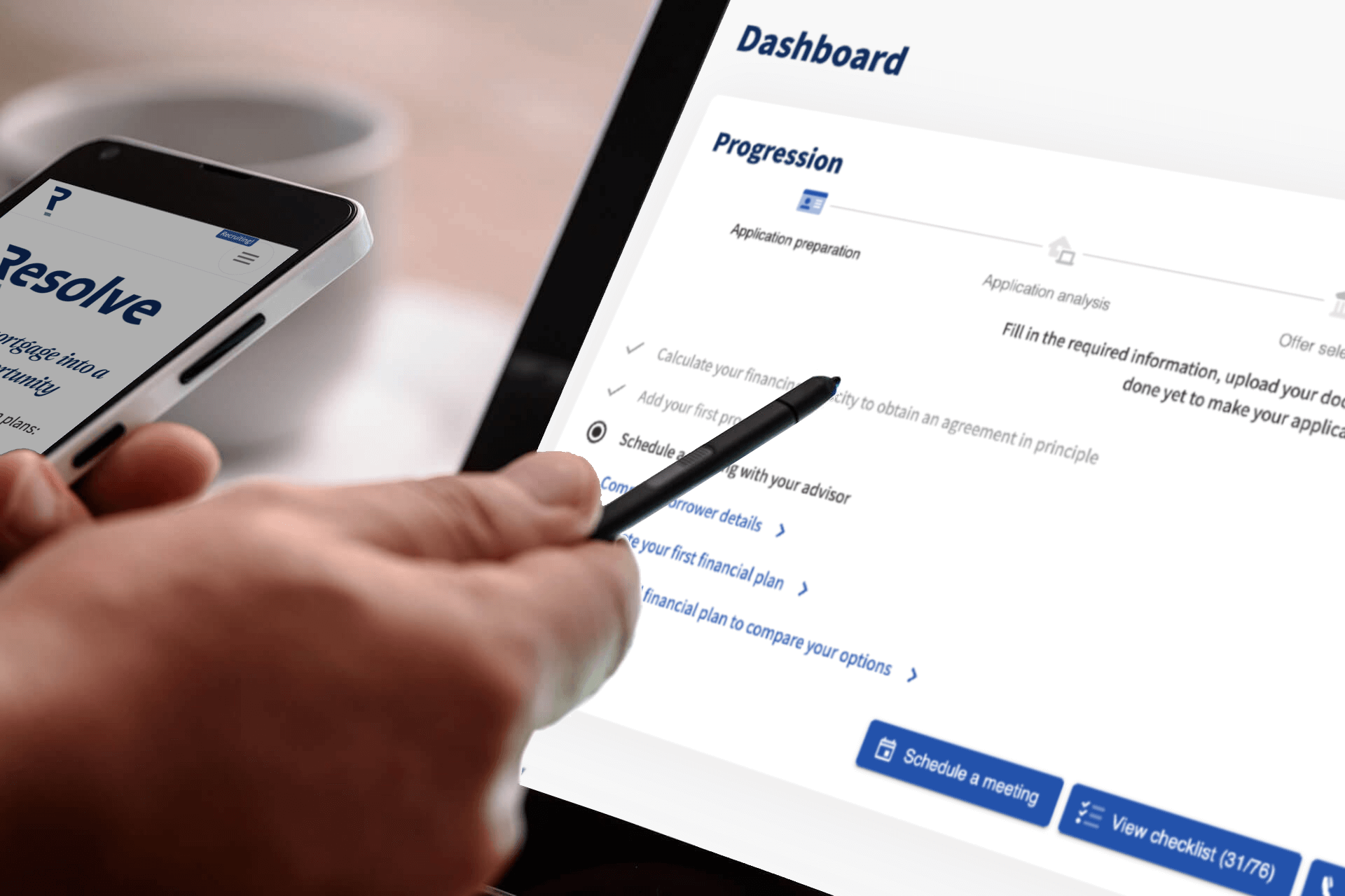

We also make life easier for our partners, who enjoy a range of benefits when they use our online platform.

Mortgage brokers maximize their results by working with us:

🔎 More transparent

Track client progress in real time online or with an adviser.

⭐️ Better quality

Our clients can access our advisers' expertise.

🤝 More reliable

We filter potential buyers by checking their creditworthiness.

💪 More efficient

All the relevant information appears on our interface.

Our developer interface is somewhere to gather important documents, manage mortgage broker access and enjoy detailed visibility in real time:

🏠 reserved plots

💰 buyer financing progress

🔬 key project stages for careful disbursement organisation

We also deal with notaries, banks and pension funds. Like an orchestral conductor, we coordinate everyone involved in a development project to ensure it goes smoothly. This reduces our partners' stress levels and makes the buyer journey easier.

Our change of name is an opportunity to better articulate our positioning, our approach and our identity.

What is our mission?

Having focused on the "how" for four years, we now want to clarify the "why" with Resolve.

We want to become the leading Swiss partner for optimized financial decision-making in the mortgage financing space.

Our mission has three parts:

- Transforming financial advice into a unique and holistic experience by combining the best that humans and technology have to offer.

- Using technology, quality data and science to find the best financial partners for our clients and their projects.

- Innovating with unique and optimised loan solutions.

This change of name marks the start of a new chapter confirming what we've always been about. To better convey our change of scope, the e-Potek start-up is making way for the Resolve scale-up.

What people say

It's always tricky changing a name. Everyone has an opinion and it can't be a truly democratic process. "Resolve" makes our long-term goal clear: empowering our clients and partners to make better financial decisions.

This name change is very exciting. Though I was proud of the name e-Potek, there was one important detail I didn't consider: the language barrier in light of our nationwide growth. We also decided to focus on advice and solution finding rather than just rates. "Resolve" resolves everything! I love the new name: it suits us perfectly!

It makes me nostalgic to move on from our old identity, but I love the new name. It will open up new opportunities and perfectly suits our modern and innovative approach.

e-Potek sounds like the French word for mortgage, "hypothèque", which is hard to spell. The name e-Potek was outdated and no longer aligned with our client's ambitions. It didn't reflect the areas covered by the business, which focuses on creating bespoke innovative digital finance solutions. "Resolve" comes with its own definition, but will also now resonate as the must-use solution to all your real estate financing problems.

This name change is happening at the right time. With the company's growth, it's a sensible move and part of its expansion. I think the name Resolve will make people think. I like how it's not to do with what the company does, but with an action associated with the service offered. It's a bold choice that will make an impact. It also shows the company provides more than just financing and digital services.