Do I Have Enough Equity to Buy Real Estate?

Buying an apartment or a house is one of your dearest wishes? Before diving into this project, accurately evaluate your financial capacity with a professional to see if your income and savings are sufficient to finance the purchase, or to explore possible solutions to achieve it. Take the time to examine your financing options carefully. This preliminary evaluation will help you make informed decisions and successfully conduct your real estate project in Switzerland thoughtfully and securely.

What Is Equity, and How Much Is Needed?

Equity refers to the assets you can mobilise compared to the total value of the property. It affects the mortgage loan's acquisition and conditions, such as its duration and interest rate. In Switzerland, equity requirements vary based on the property's value, your net worth, and the type of mortgage (primary or secondary residence). These requirements are primarily governed by the Swiss Financial Market Supervisory Authority (FINMA). While FINMA doesn't set precise thresholds, it encourages lenders to ensure borrowers have enough equity to guarantee financial stability.

Generally, when buying a primary residence, you'll need to provide 20% of the property's value as equity (30-40% for a secondary residence) and finance the rest through a mortgage. With property prices soaring over the past decade, accurately assessing your equity is essential, factoring in additional costs like notary fees (usually about 0.1% and 1% of the property's value in the German-speaking cantons, about 2.5% in Ticino and 3% to 5% in the Romandie) and future renovation expenses. Only by carefully evaluating the acquisition's total cost can you avoid unpleasant surprises and proceed confidently.

What Options Exist to Create Equity?

There are many options for generating equity, which can take different forms, and choosing one strategy over another can help you make significant savings. Using your personal savings is an immediate solution, but it can limit future investment opportunities. Selling financial assets or valuables can also bolster your equity but requires careful valuation to prevent financial loss.

Other alternatives include loans from third parties, family assistance, donations, inheritance advances, inheritances, personal labor or even utilising existing land. Equity can also come from pledging or withdrawing from the second pillar (pension fund/BVG-LPP) or the third pillar (3a/3b). Note that at least 10% of equity should not come from the second pillar or a loan, whether it's a bank, personal, or family loan. This portion of equity, mainly consisting of account balances or early withdrawal of tied assets from the third pillar, is called "hard equity." Borrowing against an already owned real estate property can also be considered hard equity. If your primary residence has appreciated, you can leverage this value (latent gain), which was previously locked in your property, as an additional contribution for a secondary residence.

Each source of equity has its pros and cons regarding taxes and retirement. Consulting advisors is recommended to determine the best approach based on your specific needs and projects.

Pledge Tax Benefits

Instead of withdrawing second-pillar assets, you can pledge them to the bank as equity. This amount then serves as collateral. In return, the bank grants a higher mortgage loan, potentially up to 90% or even 100% of the pledged amount, meaning only 10% equity is needed. Apart from the reduced down payment, this pledging can also act as a pension buyback for a limited time, offering substantial tax savings.

Common Mistakes to Avoid

During equity evaluation for real estate purchases, avoid common pitfalls. Don't use your savings without carefully assessing the long-term financial impact, which could affect your purchasing power, especially with unexpected financial burdens. Strategies like increasing savings, diversifying investments, or controlling unnecessary expenses can help boost equity.

In terms of the mortgage, shop around for multiple lenders to find the best offer. Remember, the buyer's income must be high enough to sustain long-term property expenses (amortization, indicative interest rates, maintenance, etc.). The theoretical cost shouldn't exceed one-third of your gross income. Avoid taking out a significant lease or loan before purchasing real estate, as it can increase your financial burden and reduce your mortgage capacity.

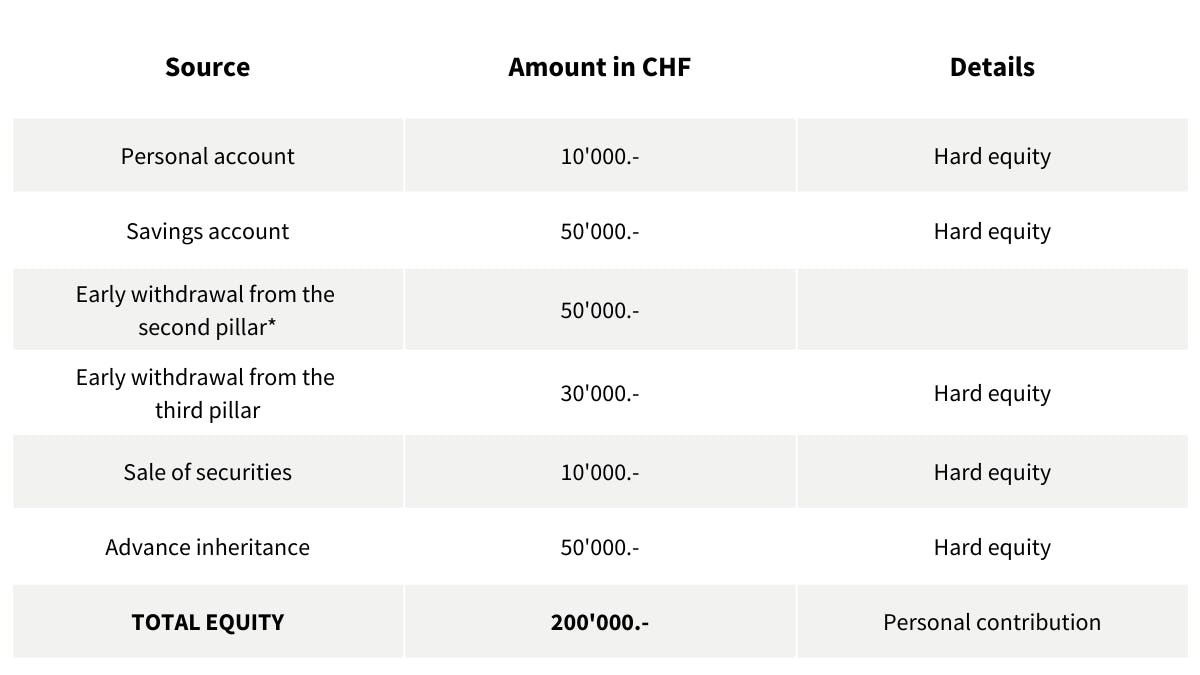

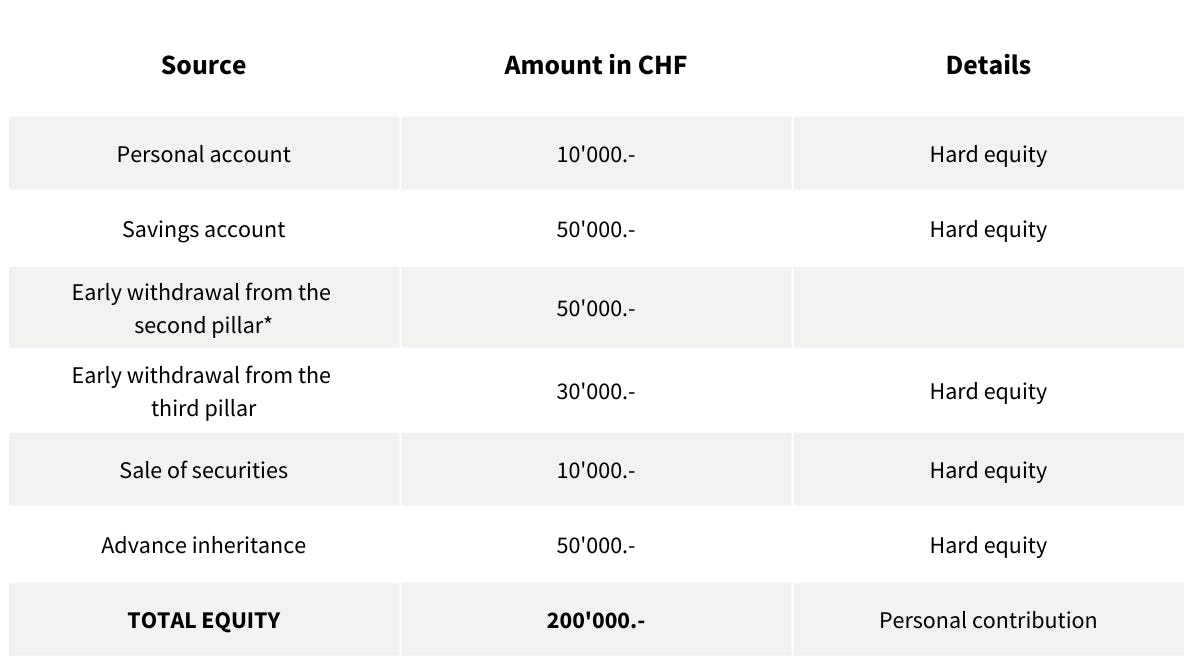

Example: equity breakdown

For example, consider an apartment valued at CHF 1’000’000.-. To buy it, you'll need to provide 20% in personal contributions, or CHF 200’000.-. Of this, at least 10%, or CHF 100’000.-, should not come from the pension fund.

(*The pension fund's minimum withdrawal is CHF 20’000.-)

Final Thoughts

Given the complexity of real estate purchases, it's essential to carefully assess your equity and strategise your acquisition. Tools like those offered by Resolve.ch make it easier to understand your financial capacity. Consulting with a financial advisor at Resolve can help you evaluate your financial situation and identify the best strategies to create the necessary capital for your purchase.

Ultimately, every situation is personal, and every property is unique. Financing is equally individual and requires thorough analysis.