How does working part-time affect retirement for women?

Over 70% of the people working part-time in Switzerland are women. This lifestyle choice does have consequences when people reach retirement. Find out more below.

Working part-time has become considerably more popular in Switzerland over the past few years, going from representing a quarter of the workforce in the early 1990s to over one third of it today. In 2021, according to the Swiss Federal Statistical Office, 1.284 million women worked part-time. The main reasons for this choice were having to look after children and shoulder other family responsibilities, the same study revealed.

This decision is not taken lightly. Typically, women calculate the effect it will have on their monthly and annual budget before deciding to reduce their working hours. They may also take account of the fact that their taxes will be lower. Taking a (very) long-term view and thinking about how this will affect their retirement is much rarer. A lower salary means lower pension contributions and thus a smaller old-age pension. But what is the actual situation? Does it make a big difference? Most importantly, how can you solve it?

How does working part-time affect the 1st pillar of your pension?

The 1st pillar (old-age and survivors’ pensions or ‘AVS’) is designed as a basic income to cover essential needs during retirement. The amount of this income is determined by the number of years’ contributions, the revenue from which the contributions were taken and any bonuses for having performed educational work or assistance.

In order to earn the maximum retirement income, which is currently CHF 2,390 (CHF 2,450 in 2023) per month, you would need to pay in contributions for 44 years and have an average annual income for reference of CHF 86,040. Although working part-time (or stopping work for reasons such as maternity leave) has no effect on the number of years’ contributions required, it typically reduces the base reference salary, which results in a lower pension at the end of the day.

Make an appointment to calculate your AVS pension

How does working part-time affect the 2nd pillar of your pension?

2nd-pillar pension services (occupational pensions or ‘LPP’) are paid out alongside old-age and survivors’ pensions to allow people to maintain their standard of living during retirement. Occupational pensions are mandatory for employees contributing to old-age and survivors’ pensions and whose gross annual salary is at least CHF 21,510 (CHF 22,050 in 2023). However, these contributions are calculated based on what is known as the ‘coordinated salary’ instead of the full salary. The coordinated salary is the gross annual salary minus the coordination. The coordination for 2022, which is set by the Swiss Federal Council, is 7/8ths of the maximum annual old-age and survivors’ pension (CHF 28,680), which works out at CHF 25,095 (CHF 25,725 in 2023). For LPP, this means that contributions do not need to be paid on the share of the salary already covered by AVS, but if you work part-time, this can have a major impact.

For example, a woman working full-time for a gross annual salary of CHF 100,000 will contribute based on an amount of CHF 74,905 (100,000 - 25,095). If that woman reduced her working hours to 60% of full time, she would receive a gross annual salary of CHF 60,000 but would then contribute based on CHF 34,905 only (60,000 - 25,095). By reducing her working time by 40%, this woman is reducing her LPP contributions by over 50%, creating an even broader pension gap.

Some pension funds offer more advantageous conditions, reducing the coordination amount based on work rates.

Make an appointment to find out more about your LPP pension services

What happens when a couple separates?

Women in a relationship can rely on there being a second salary to compensate for the drop in their work rate. Typically, couples will do their sums and adjust each other’s contributions to the family budget accordingly. But what happens when they separate?

For the 1st pillar, the joint income earned when the couple were married is shared (splitting) in the event of divorce. Only the income earned when both spouses were insured for Swiss AVS is counted as shared income, and then only for the entire calendar years for which they were married. As for the 2nd pillar, the assets acquired during the shared years of marriage must be divided equitably, regardless of the matrimonial regime.

This can therefore heighten the pension gap. Where an unmarried couple separates, however, there are no legal provisions to compensate for the woman’s part-time work. It is left up to women to do their own research if they want to be financially independent when they retire. The sooner, the better!

Make an appointment to calculate your pension gap

How much will your pension be and which solutions are available for increasing it?

In Switzerland, the average pension for women is 37% of what it is for men. To find out what you can expect, you can ask the cantonal AVS compensation fund for a free excerpt of your pension account and to calculate your pension income. If you have realised that you are a few years’ contributions short, you can pay retroactively for under 5 missing years, if you could have been insured for AVS during that period.

With regard to the 2nd pillar, the amount of this pension is shown on your annual certificate. This certificate also sets out the amount available for buying back contribution years in the 2nd pillar.

Buying back contribution years in the 2nd pillar

The 2nd pillar offers you the option of buying back years in your pension fund. This can make up for any shortfalls that may have arisen following an interruption in your paid work or a reduction in your work rate. It is a solution that can both fill any gaps in your pension and lower your taxable income, as these buybacks can be deducted from the tax levied on your taxable income.

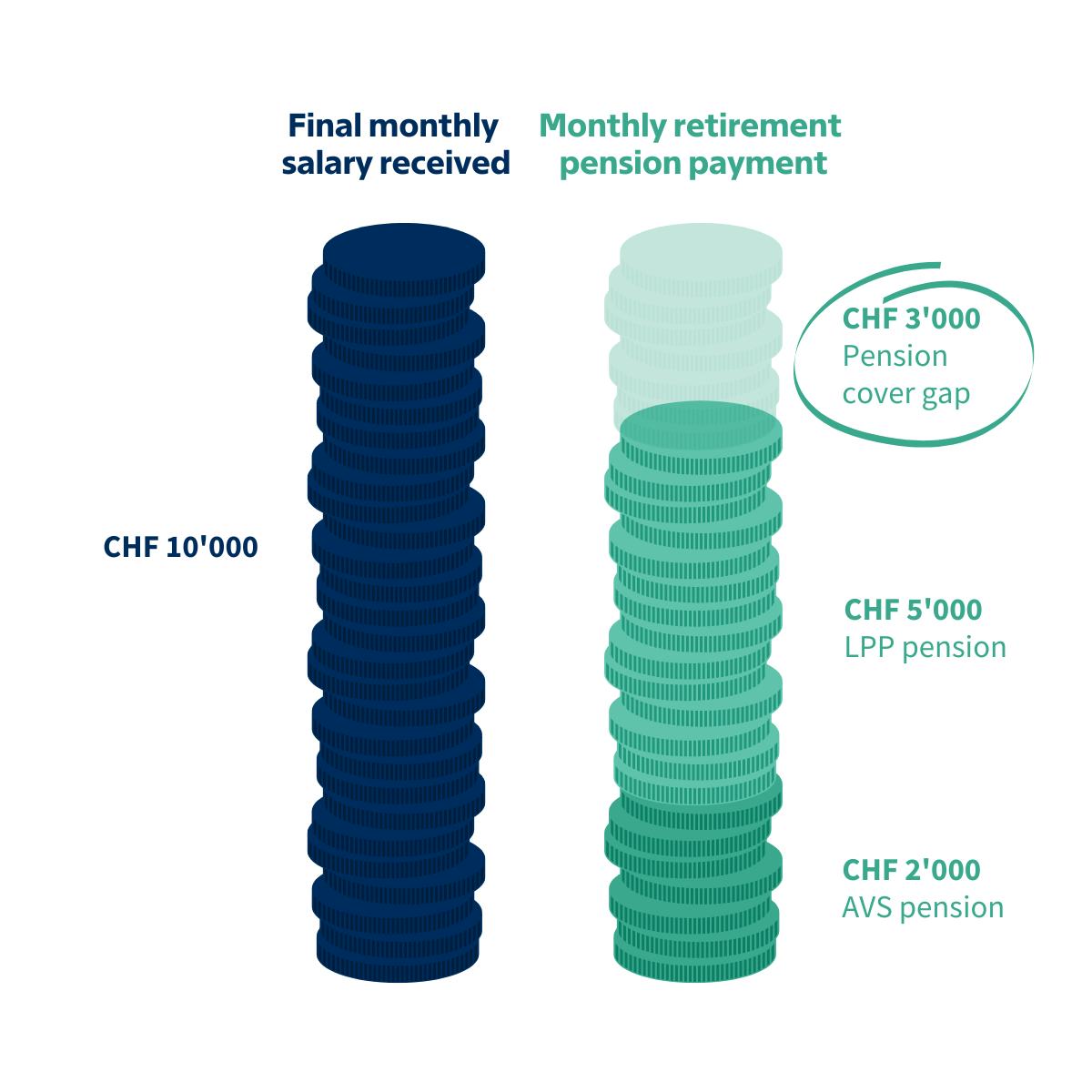

On average, the 1st and 2nd pillars cover around 60% of your final salary received. However, for someone who has spent numerous years working part-time, this percentage may turn out to be lower. This is why the Swiss pension system has a 3rd pillar, which is private and optional, and can be used to plug any gaps in pension cover.

Take out a 3rd pillar

The 3rd pillar A (connected 3rd pillar) gives people affiliated with a pension fund (usually employees) the option of paying in up to CHF 6,883 (CHF 7,054 in 2023) in contributions per year, up to 20% of their net income, with a maximum of CHF 34,416 ((CHF 35,280 in 2023)) for people not affiliated with a pension fund (typically independent workers). These amounts are regulated, as you can deduct them from your taxable income, meaning you can save a considerable amount in taxes, as well as improving your level of cover for disability and death and the services to which you will be entitled when you retire.

This pillar is said to be ‘connected’ because it can be drawn only under certain conditions (retirement, purchase of a main residence, becoming over ⅔ disabled, leaving Switzerland for good or setting up your own freelance business).

The 3rd pillar B (free 3rd pillar) offers greater freedom in the payments you can make and how you can draw it, but it is deductible from taxable income in certain Swiss cantons only (Fribourg and Geneva). In Geneva, a married couple with two children can deduct up to CHF 5,174 (2022 figure) and, depending on their marginal tax rate, will save around a third of this amount in taxes.

In both cases, the capital constituted using the 3rd pillar will also cover risks associated with death and disability.

There are therefore solutions available to reduce the impact of working part-time on your retirement. To find out which is the best solution for your personal situation and your objectives, you can have a no-obligation pension simulation done with one of our advisors. This simulation will set out your current situation and forecast your income when you retire. You will then know which levers you have at your disposal to retire in full peace of mind.

What women say about working part-time and retirement:

Now that my daughters have grown up, I could work full-time again, but I don’t want to... I want to make the most of life, while I still can. I don’t think about the affect on my retirement. I own a home that I can sell if I have to and, if need be, I’ll leave Switzerland. I want to take each day as it comes!

It was the natural decision to work less when my daughter was born, but I admit I didn’t look any further than the difference in salary at the end of the month. I wasn’t aware that I was contributing less, even though it seems logical... I’m a bit scared of calculating the actual impact, but it has to be done so I don’t get any nasty surprises!

When my daughter was born, I reduced my work rate to 80% in order to spend time with my child, and didn’t think of the impact it would have on my future. OK, my salary dropped, but it was the price to pay for having more time. A lot of people told me it didn’t matter, because my husband was working. Right now, I’m trying to strike the right balance between my finances, the time I spend with my family and my retirement. I’m thinking about investing some of my husband’s income in my LPP.

I was already working at 80% before I had children, to have more time for myself. Since my daughter was born, I have kept working part-time to spend time with her and take care of her. I would have liked to keep working at 80% but my new job didn’t give me the choice, so I’m at 60%. It makes a big difference to my salary at the end of the month and for the future as well. I do worry about it a little, especially as the Federal Council says that women should not work less than 70% to avoid affecting their pension too much! I’m lucky enough to earn a good living, but I don’t know if that’s enough. I took out a 3rd pillar, and I already found it hard paying contributions when I was working at 80%, so now that I’m at 60%, we have to make sure as a couple that we pay as much into it as we can.

I work at 100%, but I’d like to reduce that rate to have more time for myself. I know I wouldn’t have as much money in my pension, so I set up a 3rd pillar at the beginning of the year.

I started working very early, at the age of 17, but I stopped for several years. When I wanted to start again, my husband was working at 200% and, with 3 kids, there was no way I could work at 100%. At that point, I didn’t really think about the impact on the future on a day-to-day basis. I set up a 3rd pillar, but with hindsight I realise that I should have started earlier. I kept working for 3 years after retirement age to make up for it a little. We own our home, so we have a roof over our heads, but I get less than CHF 1,500 per month. I couldn’t get by on my own!