How do you read a pension fund (OP) certificate?

What is a pension fund (OP) certificate? It is a document that details all the risk benefits and retirement benefits provided by your pension fund. It contains a significant amount of important information, and it is also important to know what the actual numbers and figures mean. An explanation.

Pension fund certificates differ in terms of their presentation and although the wording which is used in them may not be exactly the same or appear in the same order, the basic concepts remain the same. Here is an example with the key elements you need to know.

Personal information: who is the insured party?

The first part consists of information about you, in general:

- Surname

- First name

- Date of birth

- Gender

- OASI number

- Marital status

- No. of insured person

It can also include your statutory date of retirement.

In terms of your marital status, some pension funds also accept the status of common law partner. This means that you can declare your partner as your spouse even if you aren’t married, so that s/he receives payments from your pension if you die. It may be necessary to fulfil certain conditions, such as a minimum number of years living in the same home or with a joint child. To find out whether this is possible for you as well as the respective conditions, the best idea is to refer to the rules governing your pension fund or to get in touch with your contact person. In any case, we highly recommend that you make this declaration, which may also be a compulsory condition for the receipt of the pension benefits.

Our pension advisors also have detailed knowledge of the rules that govern most pension funds and can provide you with further information.

I would like to know more about my pension fund

Information about your salary: what is your insured salary?

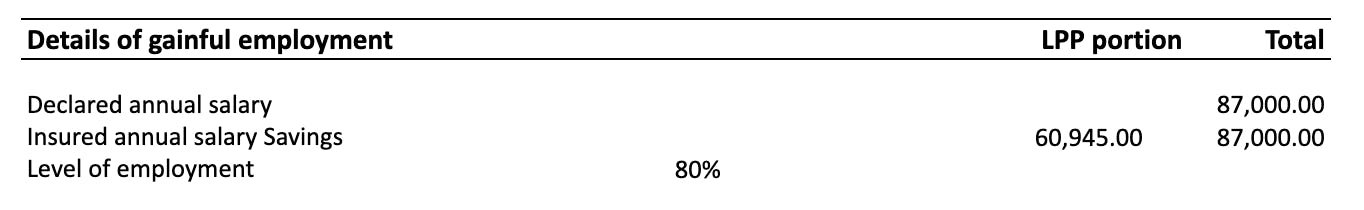

This section relates to your level of employment and also states your declared salary and your insured salary.

Your declared salary is your gross salary. Your insured salary is your salary on the basis of which the pension benefits are calculated in the event of your disability, retirement or death. It is less than your declared salary because an upper limit (CHF 88,200 in 2023) applies to the coordination deductible. In 2023, the coordination deductible, which is set by the Swiss Federal Council, is 7/8ths of the maximum annual OASI pension, i.e. CHF 25,725. This means that the contributions do not need to be paid on the share of the salary covered by the OASI.

Accordingly, someone with gross salary of CHF 80,000 will have:

- Declared salary of CHF 80,000

- Insured salary of CHF 54,275 (CHF 80,000 - CHF 25,725)

Someone with a gross salary of CHF 150,000 will have:

- Declared salary of CHF 150,000

- Insured salary of CHF 62,475 (upper limit of CHF 88,200 - CHF 25,725)

These are the minimum statutory amounts. If your employer has set up an enhanced (non-compulsory) pension plan, it is possible that your insured salary is the same as your gross salary, or that you do not have a coordination deductible.

An enhanced pension plan is one of the benefits that a company is able to offer. In doing so, it offers superior conditions of employment and stands out as an attractive employer.

The non-compulsory portion also consists of a ceiling, above which the pension fund (OP) no longer applies.

Details of your retirement assets: how much have you built up?

This section details the development of your retirement assets, which means the capital you have built up for your retirement over the course of the past year and may also distinguish between the portions that are referred to as “compulsory” and “non-compulsory”.

In this section, reference is also made to possible transferred vested pension benefits. This is the amount contributed during a previous period of employment which will have been paid and added to your current pension fund.

Details of your pension payment: how much will you receive?

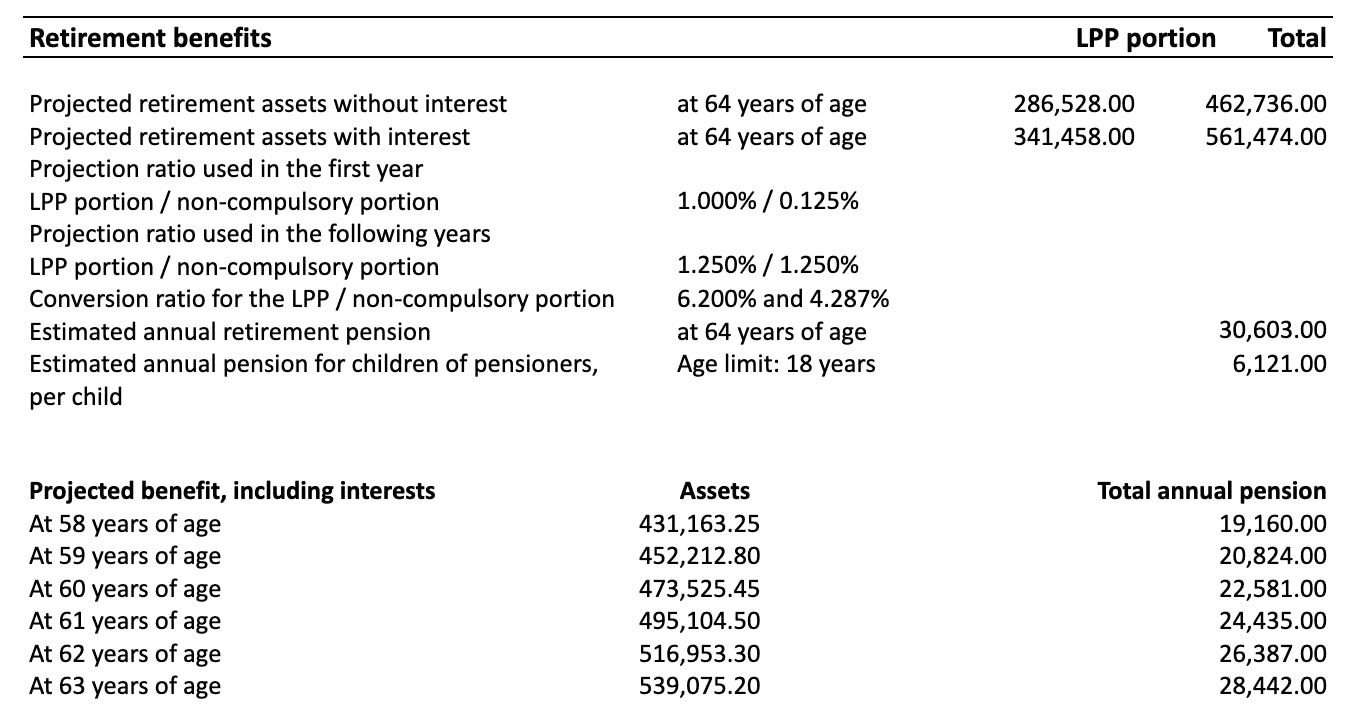

Retirement benefits

Your projected retirement capital is an estimate of the amount available to you on retirement, based on your details at the current date. Your capital is also increased by the retirement credits and compensated according to the rates indicated for the ongoing year. Your annual retirement pension, which is your annual salary as a retiree, is determined by applying the conversion rate to the retirement assets that are available on your date of retirement.

When you retire, it is possible to receive a lump sum, a pension or a mixed version. This projection helps you to visualise your choice. In the example above, if you decide to receive your retirement payment in the form of a lump sum (CHF 595,481) at age 65 and live to the age of 90, you will have an average of CHF 23,819 per year. If you choose a pension, you will receive CHF 30,965 per year, or a total of CHF 774,125. It is a difficult decision, as it depends to a great extent on your life expectancy, but also on your family situation and the things you want to do in your retirement. Please remember to consult the rules that govern your pension fund to find out the terms and conditions and deadlines regarding any requests you are required to make, so that you receive your pension fund according to your choice.

You will also find your projected capital if you decide on early retirement, which is possible at the age of 58 at the earliest.

Find out more about early retirement

The choice between a pension or a lump sum, as well as the choice of possible early retirement, must take many factors which are specific to your particular situation into account. Do not hesitate to approach a pension advisor to help you better understand all the issues that relate to these decisions, and put solutions in place which will allow you to achieve the goals you have decided on for your retirement.

Understanding my situation on retirement

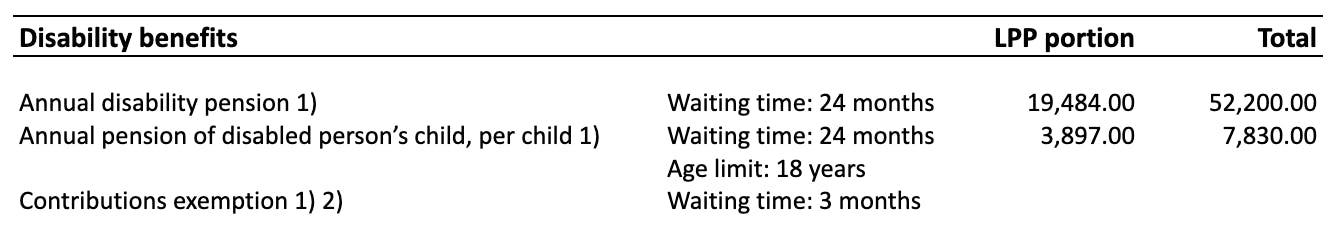

Disability benefits

This part presents the pensions to which you and your children (disabled child's pension) are entitled in the case of a disability which is recognised by the DI (Disability Insurance). The figures generally correspond to a 100% disability. If the degree of disability is lower, the right to the pension is adjusted:

| Degree of disability | Pension right (as a % of the overall pension) |

|---|---|

| 40% | 25 |

| 41% | 27.5 |

| 42% | 30 |

| 43% | 32.5 |

| 44% | 35 |

| 45% | 37.5 |

| 46% | 40 |

| 47% | 42.5 |

| 48% | 45 |

| 49% | 47.5 |

| 50-69% | The percentage of the pension corresponds to the percentage of the disability |

| 70-100% | 100% |

The release or exemption from the payment of contributions means that in the case of total or partial disability, the pension fund becomes responsible for the payment of contributions in the place of the employee and the employer.

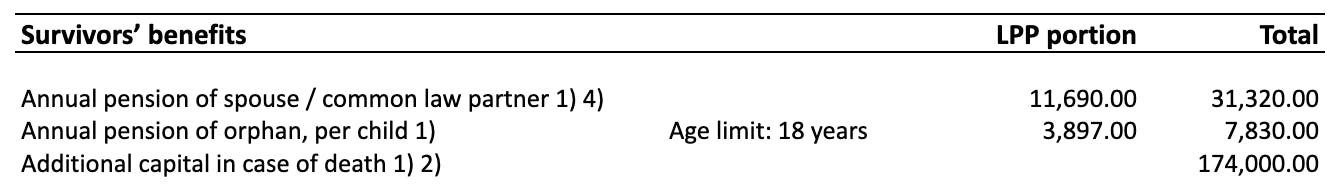

Survivors’ benefits

These are pensions that are allocated to the spouse or registered partner (or common law partner according to the rules of the pension fund), as well as to dependent orphans under the age of 18 (25 if still in education) in the case of death.

When a person in receipt of an old-age pension dies, their spouse is entitled to the payment of a pension which is equal to 60% of the old-age pension of the deceased person. In certain cases, it is also possible to grant an additional lump sum payment.

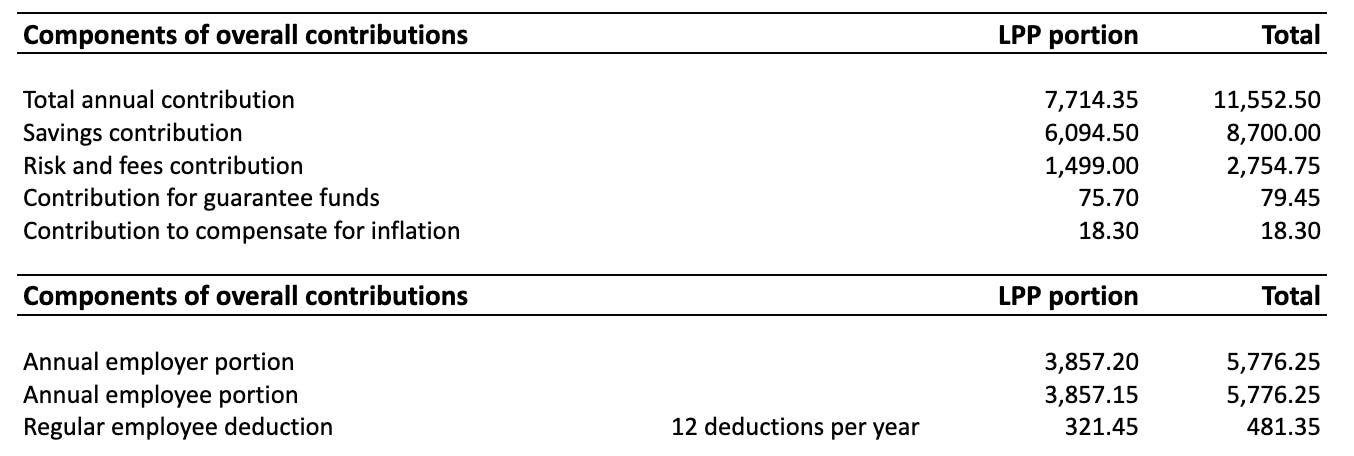

Information on contributions: who pays what?

This part discusses the components of the pension fund contribution: the employee portion and the employer portion, but also the portion of the contribution for savings, the portion for risk, etc.

The portion for risk (invalidity and death) is deducted from 1st January starting from the age of 17 (for people subject to pension fund), while the contribution for savings for retirement begins on 1st January after the age of 24.

Legally, the contributions must be paid equally between the employee and the employer. However, employers may decide to contribute a larger portion than the employee portion. This is part of the benefits package that a company is able to offer. If the salary is the same an employer who contributes more than the minimum statutory amount therefore offers better conditions. Remember to do your research when applying for a job at a new employer.

At present, the minimum contribution rates (split between the employee and employer) are as follows:

| Age | Percentage of coordinated salary |

|---|---|

| from 25 to 34 | 7% |

| from 35 to 44 | 10% |

| from 45 to 54 | 15% |

| from 55 to 65 | 18% |

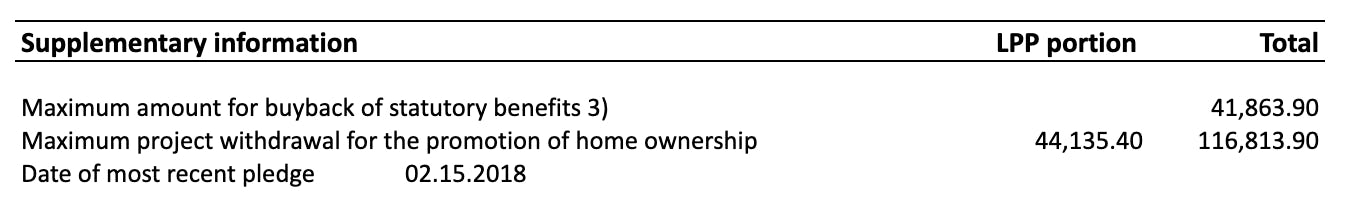

Additional information: what are your options?

Despite joining this discussion at a late stage, these details are very important as they relate to the buy-back sums and advance withdrawal option for the promotion of home ownership.

Buying back pension benefits

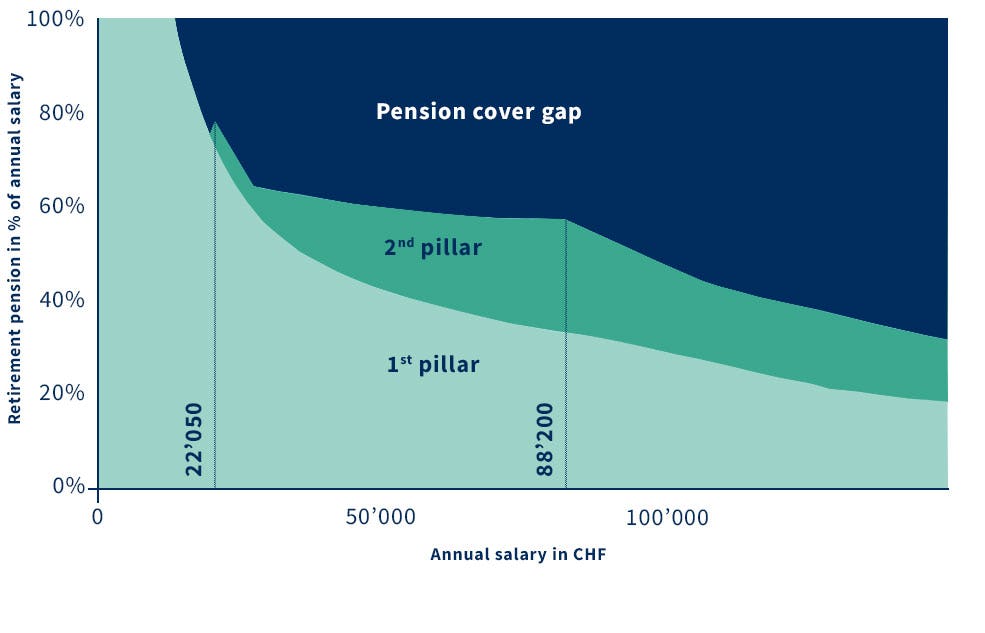

The 1st and 2nd pillar are not generally sufficient to enable a person to reach the salary they received before their retirement, creating a difference in income commonly referred to as the “pension cover gap”.

Pension cover gaps can arise at any point in time as a result of a pay rise, a change in working hours or another form of career hiatus. It is often the case that divorce or taking money out of your pension fund to buy a property may place a serious strain on your retirement savings.

In these cases, it is possible to buy back any years you have missed; the possible buy-back amount is specified here. The difference between your current retirement savings and those you could have had if you had always been in your current situation can be rectified with one single payment or staggered payments over time, the latter is usually more tax effective. If you choose to make these payments, they can generally be deducted from your taxable income; they must be carefully thought through.

For example, a person who started working at age 25 and earned CHF 60,000 for 20 years, then CHF 80,000 for 10 years, and finally CHF 100,000 for the last 10 years could buy back years until s/he reaches the same level of contributions as if s/he had been earning CHF 100,000 for 40 years.

It is possible to buy back years at any time up to the day before your retirement, however the buy-back cannot be paid out as a lump sum for 3 years (Art. 79b of the Swiss Federal Act on Occupational Pension Provision LPP).

It is also possible to take out a 3rd pillar, a private and optional pension plan, to compensate for a pension cover gap. This solution has many advantages, including tax advantages, as contributions to the 3rd pillar are tax-deductible.

Find out more about the 3rd pillar

Amount available for the promotion of home ownership (WEF)

The pension fund allows the insured person to finance the purchase of their principal residence with their occupational pension plan. There are two options: the advance withdrawal and the pledge. The choice you make will have implications regarding tax and your retirement, which is why it is important to study the situation carefully before making a decision.

I want to use my pension fund to buy a property

As you can see, this document contains a considerable amount of important information about your retirement pension planning and your risk coverage. It should also be mentioned that you should refer to the rules governing your pension fund, as they contain a lot of crucial information.

At Resolve, we take the time to analyse your pension situation on a point-by-point basis together with you. We analyse your coverage in detail so that we are able to propose solutions according to your personal situation, so you can achieve your goals.

Source : https://www.fedlex.admin.ch/eli/cc/1983/797_797_797/fr